In today’s fast-paced financial world, forex trading company forex-vietnam.net stands out as a testament to the advancements in trading technology and accessibility. Forex trading firms are at the forefront of this evolution, providing essential services to both novice traders and seasoned investors. The forex market, known for its liquidity and accessibility, has garnered immense popularity, attracting millions of traders around the globe. In this article, we will explore the rise of forex trading companies, their role in the financial ecosystem, and how they support traders in navigating the complexities of the forex market.

The Forex Market: An Overview

The foreign exchange market, or forex, is one of the largest and most liquid financial markets in the world. With an average daily trading volume exceeding $6 trillion, it dwarfs other financial markets. This market operates 24 hours a day, five days a week, allowing traders from different time zones to participate at their convenience.

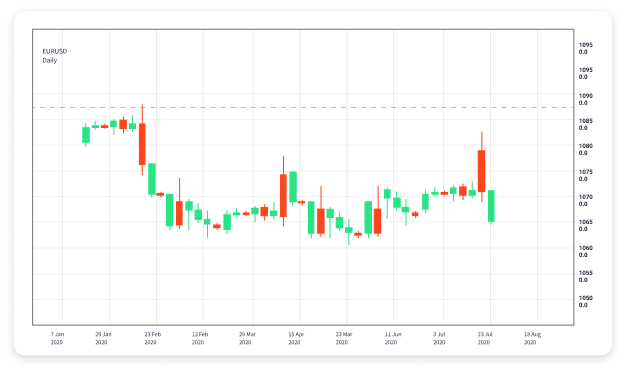

Forex trading involves buying one currency while simultaneously selling another. Major currency pairs include EUR/USD, USD/JPY, and GBP/USD, but there are countless other pairs that traders can explore. The volatility and liquidity of these pairs offer traders numerous opportunities to profit from price movements.

The Emergence of Forex Trading Companies

As the forex market began to gain traction in the late 20th century, so did the rise of forex trading companies. These firms emerged to facilitate trading by providing technology, market access, and liquidity. They serve a critical role in connecting traders with the larger forex market and often provide a range of services, including trading platforms, educational resources, and market analysis.

Types of Forex Trading Companies

Forex trading companies can be categorized into two primary types: brokers and market makers. Each type has its unique features and benefits:

- Brokers: Forex brokers act as intermediaries between traders and the interbank forex market. They earn commissions or spreads on the trades executed through their platforms. Brokers can be further divided into various categories, including ECN (Electronic Communication Network) brokers, STP (Straight Through Processing) brokers, and market-making brokers.

- Market Makers: Market makers provide liquidity by standing ready to buy and sell currencies at quoted prices. They set the bid and ask prices and make a profit from the spread. While they help facilitate trading, there can be a conflict of interest, as they might benefit if traders lose money.

The Benefits of Using Forex Trading Companies

Utilizing a forex trading company offers a plethora of advantages for both new and experienced traders:

1. Access to Technology and Tools

Forex trading companies invest heavily in advanced trading platforms equipped with real-time data, charting tools, and analytical resources. This technology empowers traders to execute trades swiftly and make informed decisions based on market conditions.

2. Educational Resources

Many forex trading companies understand the importance of education and offer a range of resources, including tutorials, webinars, and articles, to help traders improve their skills. These resources are particularly beneficial for newcomers to the forex market.

3. Customer Support

Excellent customer support is paramount in the trading world. Forex trading companies often provide 24/7 assistance to their clients, ensuring that traders can resolve any issues promptly and efficiently. This support can be crucial, especially during volatile market conditions.

4. Account Flexibility

Forex trading companies cater to a diverse clientele with varying risk profiles. Many firms offer multiple account types with different leverage options, making it easier for traders to choose an account that aligns with their trading strategy.

Choosing the Right Forex Trading Company

With a plethora of forex trading companies available in the market, selecting the right one can be daunting. Here are some factors to consider when choosing a forex trading company:

1. Regulation

It is essential to ensure that the trading company is regulated by a reputable financial authority. Regulation provides traders with a level of protection, ensuring that the firm adheres to specific operational standards.

2. Trading Fees

Compare the trading fees, including spreads and commissions, from different companies. Some firms may offer lower fees but might compensate with wider spreads, while others may charge higher commissions but provide more robust services.

3. Platform and Tools

Evaluate the trading platform offered by the company. A user-friendly, feature-rich platform can significantly enhance the trading experience, while a cumbersome interface can hinder decision-making.

4. Customer Reviews

Research customer reviews and experiences to gain insights into the firm’s reputation. This can help potential clients understand the quality of service and support provided by the trading company.

The Future of Forex Trading Companies

As the world continues to embrace technology, the future of forex trading companies looks promising. Innovations such as algorithmic trading, artificial intelligence, and blockchain technology are reshaping the forex landscape, offering new opportunities for traders and companies alike.

The increasing popularity of mobile trading apps allows traders to manage their portfolios on the go, making forex trading more accessible than ever before. Furthermore, as regulatory bodies adapt to changes in technology, security measures will only increase, promoting greater trust in digital trading environments.

Conclusion

Forex trading companies play a pivotal role in the financial ecosystem, bridging the gap between traders and the dynamic forex market. By providing essential tools, resources, and support, these firms empower traders to seize opportunities and navigate challenges in the ever-evolving landscape of currency trading. As technology continues to advance, we can expect forex trading companies to innovate and evolve, making the art of forex trading more accessible and efficient for all.